Money Management For Traders

"Traders ke liye Raqam Ki Tijarat Ka Intizam"

- Bazari Maalumat:

- Pehle toh, apko market ki maalumat hasil karni chahiye. Isme shamil hai samajhdari se tijarat karna, sambhal kar maalumat ikhatta karna aur market trends ko samajhna.

- Mudat Tijarat Ka Faisla:

- Apne liye ek mudat tay karen ke aap kis samay tijarat karenge. Kuch log din bhar trading karte hain jabke doosre sirf kuch ghante ke liye.

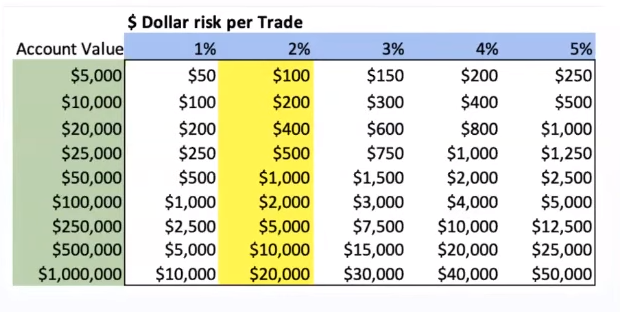

- Sarmaya Ko Taqseem Karain:

- Apna sarmaya taqseem karen. Ziadah tar traders 2% se zyada apne sarmayay ka istemal nahi karte hain ek hi tijarat mein.

- Stop-Loss Aur Target Tay Karna:

- Har tijarat ke liye stop-loss aur target tay karen. Isse nuksan se bacha ja sakta hai.

- Mudat Ke Mutabiq Trading:

- Agar aap kuch din ya kuch ghante ke liye trading kar rahe hain, toh apne trading plan ko us mudat ke mutabiq tay karen.

- Risk Ka Zikar:

- Har tijarat mein kya nuksan hone ka khatra hai, isko samajhna zaroori hai. Ziadah risk wali tijaraton se bachain.

- Tijarat Ka Safar Nigah Mein Rakhna:

- Trading ko lamba muddat ka safar samajhna chahiye. Kuch dino mein nuksan ho sakta hai, lekin agar aap apne plan ko barqarar rakhte hain, toh lambay muddat mein faida hoga.

- Nigadasht Aur Bardasht:

- Nuksan ka samna karna mushkil hota hai lekin yeh trading ka aik hissa hai. Isko sambhal kar bardasht karna zaroori hai.

- Mudat aur Sarmaya Ka Tijarat Plan:

- Trading plan banaen jo aapki mudat aur sarmaya ke mutabiq ho. Is plan mein entry aur exit points, risk management, aur profit targets shamil karen.

- Tijarat Ke Records Rakhain:

- Apni tijarat ko track karen. Konsi tijarat mein kitna munafa hua ya nuksan howa, yeh records aapko future mein behtar faislon mein madadgar sabit honge.

- Tajaweezat Aur Sudhar:

- Apne trading plan mein tajaweezat aur sudhar karte rahen. Market dynamics badalte rehte hain, isliye apne tijarat plan ko haftay ya mahinay mein aik bar zaroor dekhen aur zarurat padne par usay update karen.

Yeh tips traders ke liye mufeed ho sakti hain, lekin yaad rakhein ke har shakhs kaafi had tak alag hota hai. Apne maqasid, istehkam aur maali halat ke mutabiq apne tijarat ka intizam karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим